Legal banking package

Keeping your finances rock-solid so you can focus on getting the win for your clients

As Colorado’s leading credit union, Ent delivers local service and exceptional value. On average, we’re able to show a projected annual savings of more than $2,9111 compared to other business banking providers.

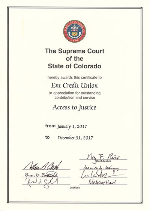

Recognized by the Colorado Supreme Court

Recognized by the Colorado Supreme Court

As a Prime Financial Partner of the Colorado Lawyer Trust Account Foundation (COLTAF), Ent was recognized by the Colorado Supreme Court for its, ‟outstanding contribution and service” in helping to provide ‟Access to Justice” for low-income Coloradans.

Additionally, Ent Business Banking provides the accounts — including a fee-free2 COLTAF checking account — and services that deliver a seamless banking experience.

Ent’s legal banking package includes:

- Business dividend checking3 so you can earn dividends on your account balance at tiered rates with no minimum balance or monthly maintenance fees

- Merchant services, including:

− Debit and credit card acceptance over the counter, electronically or via mobile

− EMV “chip” card compliant point of purchase terminal

− 24/7 live support - Payroll services – a complete payroll processing solution that could save your business of up to 20% in processing costs4

- ACH origination services

- Remote deposit that lets you deposit funds remotely from your desktop

- Free online and mobile banking including bill pay5 allowing you to manage your accounts online and on the go with:

− Entitlements to set employee permissions

− Alerts and push notifications to monitor your accounts

− Switch accounts to link your Ent accounts within online and mobile banking - Business lending packages

− Commercial real estate loans with long-term purchase or refinance options

− Revolving lines of credit for easily accessible financing with no annual fee

− Accounts receivable financing6 for flexible, asset-based financing - Business auto and commercial vehicle loans that give you fixed-rate financing with flexible terms and no application fee

- Free Ent business seminars for you and your employees

Open your Ent legal banking package by contacting us at 719-574-1100 or 800-525-9623