Have you ever looked at your budget and wondered how you will cover all your bills? If you’re feeling constantly behind as you navigate your debt, there is a reason. Debt is math, but it also requires attention and introduces stress and mandatory routines. Each extra account adds another due date and another minimum payment. Even worse, it leaves you feeling like you are one mistake away from chaos.

In debt consolidation psychology, the numbers matter, but so does the structure of your debt system. When the plan is easier to run, you follow through more often. That follow-through is what pays off debt.

Lesson Notes:

Lesson Notes:

A lot of people assume that if the math works, the stress should disappear. In reality, when you manage debt, you are dealing with its complexity not just your balances. Managing multiple accounts can create decision fatigue. You keep choosing what to pay, when to pay, and how much to pay. Over time, these small choices drain mental energy and make it easier to procrastinate. You might be doing everything right and still feel overwhelmed.

Research supports this. In one study on debt and cognition, the authors wrote: "Taken together, debt mental-accounting costs appear to cause greater impairment of psychological and cognitive functioning than debt levels do." (Ong et al., 2019). In plain terms, tracking debt taxes your brain even before the interest rate does.

When your mind is overloaded, it’s harder to keep up with the habits that keep you on track. You might miss a payment because you forgot a due date or avoid opening statements because they make you anxious. Stress can also lead to impulsive choices, making you focus only on what feels urgent or comforting right now. This is how debt quietly gets in the way of your budgeting and good intentions.

When debt keeps stressing you out, it makes you feel less secure each month. Instead of planning ahead, you’re just trying to get by. You end up dealing with late fees, overdrafts, surprise bills, and the fear that one tough week could set you back. That’s why debt can feel personal, even if it started with something practical like car repairs or a medical bill. The emotional side is real, and it shapes how you act.

Some of this emotional experience is tied to financial stress. Bankrate reported that 43% of U.S. adults said money negatively impacts their mental health (Bankrate, 2024). That’s why if you are juggling multiple payments, you’ll likely feel stressed. Every additional debt account can add another worry to your day.

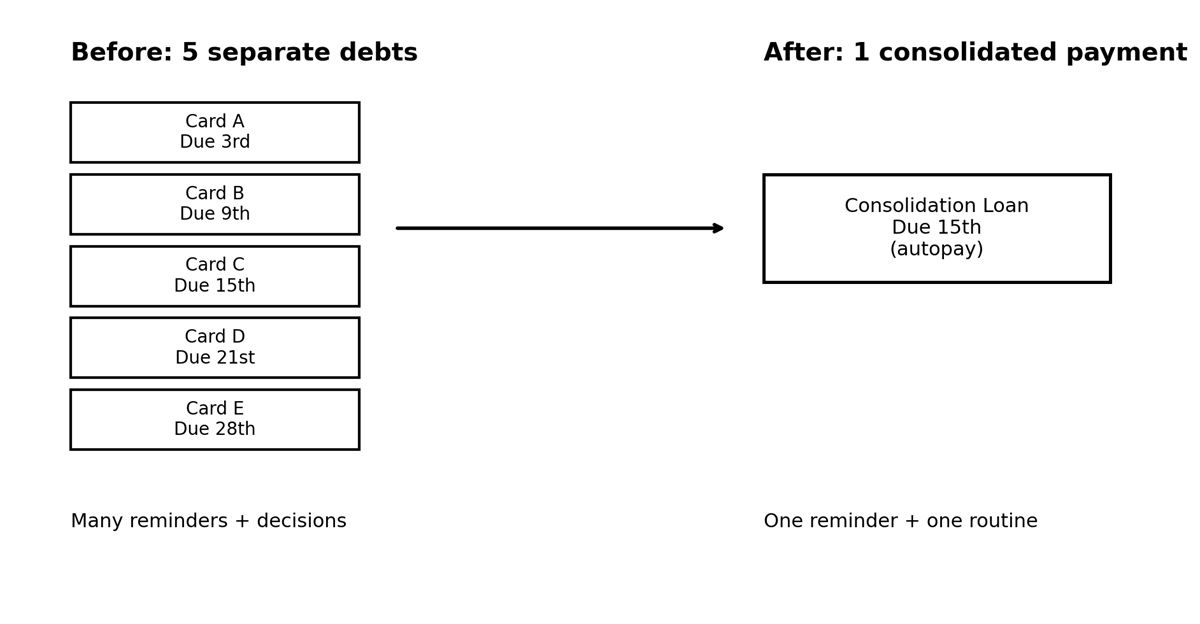

Example showing how 5 cards impact mental bandwidth

Five cards mean 5 due dates, 5 minimums, and 5 chances to forget. You’re also tracking which payments are set up for autopay and which you handle manually. One missed payment triggers fees and instantly raises stress.

|

Creditor |

Balance |

APR |

Due date |

Minimum |

|

Card A |

$2,100 |

24.99% |

3rd |

$65 |

|

Card B |

$3,450 |

19.99% |

9th |

$105 |

|

Card C |

$1,800 |

27.99% |

15th |

$55 |

|

Card D |

$4,600 |

22.49% |

21st |

$145 |

|

Card E |

$900 |

18.99% |

28th |

$35 |

When juggling multiple debts like in the example above, you feel like you’re always behind, even if you have a viable plan to manage it. Feeling stuck makes people less likely to check statements or plan. Additionally, under stress, the brain seeks quick comfort, leading to impulse spending or treats.

Consolidation can lower your interest rate or monthly payments, which is helpful. But the real benefit is that having just 1 payment changes your habits. It gives you 1 clear goal instead of several small problems to manage. Seeing your progress each month can also keep you motivated.

Figure 1: multiple debts vs. one consolidated payment.

Zoom in: Member experience

A member who was not missing payments still felt exhausted from constantly moving money between accounts to avoid late fees. After consolidating into a single fixed payment, they described the biggest change as emotional: less checking, fewer mini-panics, and a routine they could keep, even during a busy month. With that breathing room, they stuck to a weekly spending limit and started building a small emergency cushion. They stopped viewing every email alert as a crisis and started enjoying managing their personal finances.

Consolidation works best when paired with habits that prevent balances from returning. In other words, debt consolidation psychology is about designing a payoff system you follow.

If you’ve ever tried to find the perfect way out of debt, you know that the best plan on paper doesn’t always work in real life. Often, the plan that works best is the one you can keep up with, even when life gets busy or stressful. That momentum is a mental boost that keeps you going.

Scenario comparison:

Option A: Saves you $20 per month in interest but requires 4 separate payments and constant tracking.

Option B: Turns the payoff into 1 automated payment with a clear end date.

Option B is more likely to help you avoid missed payments and late fees because it requires only 1 payment. If you have a busy schedule or struggle with decision fatigue, this simple approach works better than complicated systems you can’t keep up with.

It may not be for everyone, but if you know you burn out on repetitive administrative tasks, a plan that reduces cognitive load (fewer logins, fewer dates, fewer minimums) may be the right one for you. Seeing your single balance drop each month strengthens your “I can do this” mentality. That is why debt consolidation psychology values simplicity as much as savings.

Your credit union can help by offering structured consolidation options and transparent terms, plus support that is tailored to your situation. The goal is to align your monthly payment with your payday and your financial habits. You can also meet with a financial coach who can help you create a personalized debt payoff plan and provide guidance every step of the way.

If you want more step-by-step help, you can learn more about debt consolidation and other ways to manage debt. If stress is an issue, we also offer resources on financial stress.

The final question is whether consolidation fits your situation right now. Consolidation is not a cure-all, and it is not always the first step. But when it reduces complexity and lowers cost, it is a smart move. The key is to evaluate both the numbers and the behavior you will need to succeed.

Characteristics of a good consolidation candidate include:

Situations where consolidation may not help

Consolidation may not make sense if your income is temporarily unstable or if the new loan has higher total costs. Also, it might not work out when you are trying to solve a spending problem without changing your habits. Be cautious if you are moving unsecured debt into a secured loan without a clear plan and full understanding of the risks.

Pair consolidation with a budget plan

If you consolidate debt but keep cards active without guardrails, temptation stays high. Consider lowering limits, moving cards out of reach, and following a budgeting plan that keeps your expenses in check.

Credit unions support long-term progress

If you are ready for consolidation, your credit union offers transparent pricing and personalized solutions that fit your situation. You likely want more than a loan and are looking for clarity, education, and a plan that fits your life. We also emphasize member education and support. Pairing consolidation with coaching and tools turns a short-term fix into a long-term habit change.

Why does debt feel stressful even when I can afford the payments?

Because debt isn’t just a payment, it’s ongoing mental tracking. Multiple balances, due dates, and statements create constant reminders and decision fatigue. That extra cognitive load can increase anxiety and make follow-through harder, even when your budget technically works.

Does debt consolidation really help people pay off debt faster?

Yes. Consolidation may lower your interest rate, reduce late fees, and simplify payments. The biggest payoff advantage comes from consistency. With 1 payment that is easier to manage, you are less likely to miss payments or quit your debt repayment plan.

Is consolidation more about psychology than interest rates?

For many borrowers, yes. Interest rates matter, but staying consistent matters just as much. If simplifying your system reduces avoidance and improves habits, the psychological benefit can be the difference maker.

What types of debt can be consolidated?

Commonly, unsecured debts such as credit card debt and some personal loans can be consolidated. Some people also consolidate other debts with home equity products, but this introduces additional risk because your home may serve as collateral.

How can a credit union help with debt consolidation?

Your credit union can help you evaluate whether consolidation fits your situation by clearly explaining the options available to you. We can also offer structured products with transparent terms, plus education and tools, such as a debt payoff calculator, so that you can build a payoff plan that works for you. In some cases, your credit union may also partner with trusted non-profit organizations to provide additional debt solutions, counseling, or resources designed to support long-term financial stability.

Ong, Q., Theseira, W., & Ng, I. Y. H. (2019). Reducing debt improves psychological functioning and changes decision-making in the laboratory. Proceedings of the National Academy of Sciences, 116(15), 7244–7249. https://pmc.ncbi.nlm.nih.gov/articles/PMC6462060/

Bankrate. (April 30, 2025). Survey: 43% of Americans say money is negatively impacting their mental health. https://www.bankrate.com/banking/money-and-mental-health-survey/

*PLEASE NOTE: This article is intended to be used for informational purposes and should not be considered financial advice. Consult a financial advisor, accountant or other financial professional to learn more about what strategies are appropriate for your situation.