Most of us don’t choose a financial institution because we love paperwork. We choose one because we want paychecks to land on time, cards to swipe reliably, and loans to feel fair when a big life expense shows up. One phrase you’ll hear most when comparing banking options is member-owned credit union. If you’ve ever wondered what is a credit union or compared a credit union to a bank, you’re in the right place to learn more.

Lesson Notes:

Lesson Notes:

Although credit unions and banks seem similar, the primary difference lies in the ownership of the institutions and what they are designed to do after operating expenses and managing risk. That ownership and purpose difference is what shapes decision making. It’s also why the credit union versus bank question matters even if both offer the same products.

Ownership and purpose

Most banks are for-profit companies. Customers use the products, but ownership belongs to shareholders. Therefore, bank leaders are incentivized to generate profit and increase shareholder value by creating new products or services, managing risk, and charging prices that will produce a sustainable return.

In contrast, credit unions are cooperatives. The National Credit Union Administration (NCUA) describes a credit union as “a member-owned and controlled, not-for-profit, cooperative financial institution” created to provide members with affordable financial services (NCUA, 2025). That means members are customers and owners at the same time.

Therefore, in credit unions, value flows back to members-owners rather than outside investors. First, net income generated by a credit union is reinvested in the institution through capital and service enhancements. Alternatively, it’s distributed to members as dividends, lower loan interest rates, and fewer fees.

How decisions are made

Ownership changes accountability. Banks answer to shareholders while credit unions are accountable to their members through democratic governance, which entails “one member, one vote, regardless of shares owned” (NCUA, 2025). That’s the essence of a member-owned credit union: members elect the board. Additionally, they can raise concerns through formal channels and influence direction over time.

A quick comparison snapshot

Here’s a simplified snapshot. Individual institutions vary, but these points reflect the underlying structure.

|

Dimension |

Credit union |

Bank |

|

Who owns it? |

Members (account holders) are owners |

Shareholders or investors |

|

Primary purpose |

Member value and safe, affordable services |

Profits and shareholder returns |

|

Where net income goes |

Reinvested and returned to members (e.g., dividends, better pricing) |

Retained earnings and dividends/buybacks for shareholders |

After you understand ownership, the next question is: where do earnings go? All financial institutions cover expenses and hold capital for safety. The difference is what the institution is designed to optimize after that. Typically, banks are optimized to generate returns for shareholders, while credit unions are run to deliver value to members. That incentive shows up in loan pricing, deposit yields, and fee structures.

Rate example based on national averages

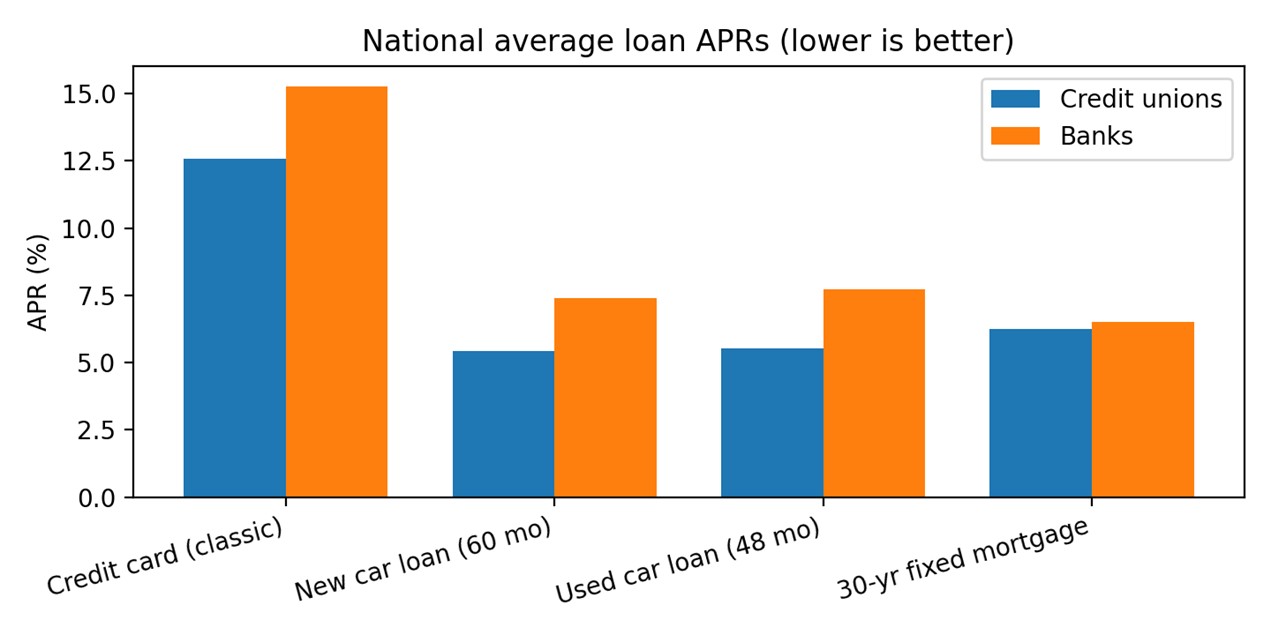

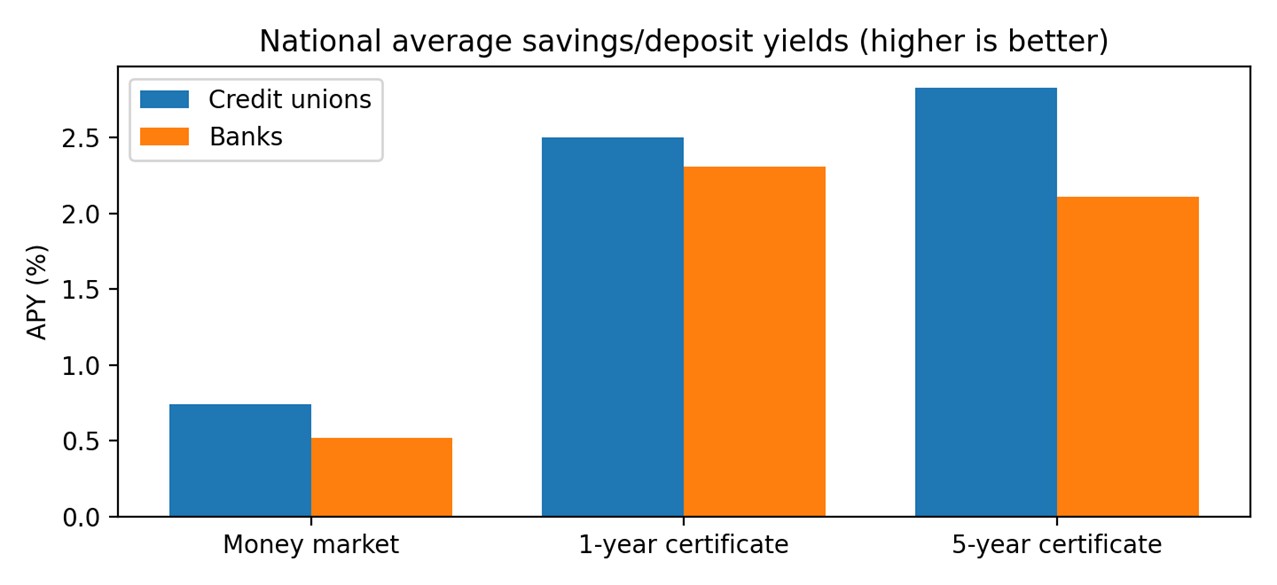

The NCUA provides quarterly national average data on common financial products. During the 4th quarter of 2025, credit unions had lower interest rates across multiple headline products than banks did. For example, the average credit card annual percentage rate (APR) for a classic credit card was 12.58% at credit unions versus 15.27% at banks. Additionally, common auto-loan terms were lower at credit unions than at banks, while certificate yields were often higher (NCUA, 2026).

Figure 1. National average loan APRs (NCUA Credit Union and Bank Rates 2025 Q4).

Figure 2. National average savings/deposit yields (NCUA Credit Union and Bank Rates 2025 Q4).

Transparency in pricing and product design

Besides the rate advantages above, transparency is another strength of credit unions. Due to their member orientation, credit unions tend to offer clear disclosures and plain-language fee explanations. Their product terms can be summarized in a few sentences, and if you need clarification, credit union representatives are readily available to answer questions.

Comparison checklist

Being a member-owned credit union means more than access to credit at low rates and having transparency into product and pricing. Member-owned credit unions are structured to allow members to influence how the institution operates through democratic governance. That means members participate in the election of its board of directors and provide input into the direction of the credit union through formal channels.

One member, one vote

In a credit union, voting power is not tied to account balance size. The cooperative model stresses democratic control: one member-one vote (NCUA, 2025). That helps keep decision-making anchored to member impact rather than a small group of large investors. The credit union governance model emphasizes fairness; members with modest balances still count.

Relationship banking tips the scale in the credit union versus bank debate. Having a great rate on paper is worthless if you cannot get answers to your questions, resolve problems, or obtain guidance when needed. That is why many credit unions practice relationship banking and view you as a partner, not a transaction.

Focus on long-term relationships

Generally, financial institutions succeed when they process high volumes of transactions efficiently, quickly, and at low cost. However, for most credit unions, success is measured by their members' success, not by the volume of transactions processed. The focus on member success results in a service model that values consistency and personalized service.

Personalized service and financial education

If you desire a relationship with your financial institution, then a credit union is the best choice. They are focused on providing guidance and education to their members and, when problems arise, they offer quick resolutions. Because of their member-focused approach, credit unions offer proactive support, reflected in clear answers, member education, fewer handoffs, and products that fit your goals.

Local decision-making and trust

Since credit unions make loan decisions locally, they consider the full context of an applicant's loan request. Local decision-making at a credit union makes it easier to approve reasonable exceptions to a loan, for example, by providing an explanation for a one-time credit error or by structuring terms to fit a member's actual budget.

Additionally, since credit unions are federally insured, members of a credit union have confidence that their deposits are protected by the National Credit Union Share Insurance Fund, which is backed by the full faith and credit of the United States, and insures member deposits up to $250,000 (NCUA, 2024).

The deposits credit unions collect are used to make loans to local residents and businesses. This is why credit unions play a massive role in supporting regional economies. The positive effects of using a credit union can be seen in the ripple effect of the loan dollars flowing through local economies to help small businesses, homebuyers, and those on daily commutes, all of whom require access to affordable financing.

Why community investment matters

The best credit unions connect member success to community prosperity. By providing competitive loan pricing, financial education to avoid costly mistakes, and supporting stable employment through local business lending, credit unions promote healthy communities. That’s the promise of cooperative finance. The institution's prosperity is tied to the well-being of its members, not to shareholder returns.

Are credit unions safer than banks?

Both can be safe when federally insured and well managed. The Federal Deposit Insurance Corporation (FDIC) provides insurance for banks while the NCUA issues insurance for credit unions, up to $250,000 per depositor, per institution, per ownership category.

Why do credit unions often have better rates?

A member-owned credit union is not designed to maximize shareholder returns, therefore it can focus on returning value to members through pricing. This includes lower loan rates, higher dividend payments on deposits, and fewer fees. The NCUA reports that credit unions often have lower APRs than banks for loans and credit cards.

Do credit unions offer the same digital tools and services as banks?

Many credit unions do offer the same digital tools and services as banks, however, the degree of capability needed by each individual varies. When comparing a credit union to a bank, examine the digital tools you actually utilize: mobile deposit, Automated Clearing House (ACH) transfers, bill payment, budgeting, alerts, and card management. Do not assume that one is inherently superior to the other; evaluate the key features and customer service of both.

Who owns a credit union?

A credit union is owned by its members, those individuals who establish accounts and use the credit union's services. Each credit union member is a co-owner with voting rights, typically one member, one vote.

How do I become a credit union member?

To become a credit union member, begin by examining eligibility (workplace, community, or association affiliation); then open a membership account online or visit a local service center. Typically, a small deposit is required to open your account and become a member.

National Credit Union Administration. (2025, June 17). Overview of federal credit unions. https://ncua.gov/regulation-supervision/manuals-guides/federal-credit-union-charter-application-guide/overview-federal-credit-unions

National Credit Union Administration. (2026, January 15). Credit union and bank rates 2025 Q4 (for December 26, 2025). https://ncua.gov/analysis/cuso-economic-data/credit-union-bank-rates/credit-union-and-bank-rates-2025-q4

National Credit Union Administration. (2025, May 20). Share Insurance Coverage. https://ncua.gov/consumers/share-insurance-coverage

*PLEASE NOTE: This article is intended to be used for informational purposes and should not be considered financial advice. Consult a financial advisor, accountant or other financial professional to learn more about what strategies are appropriate for your situation.