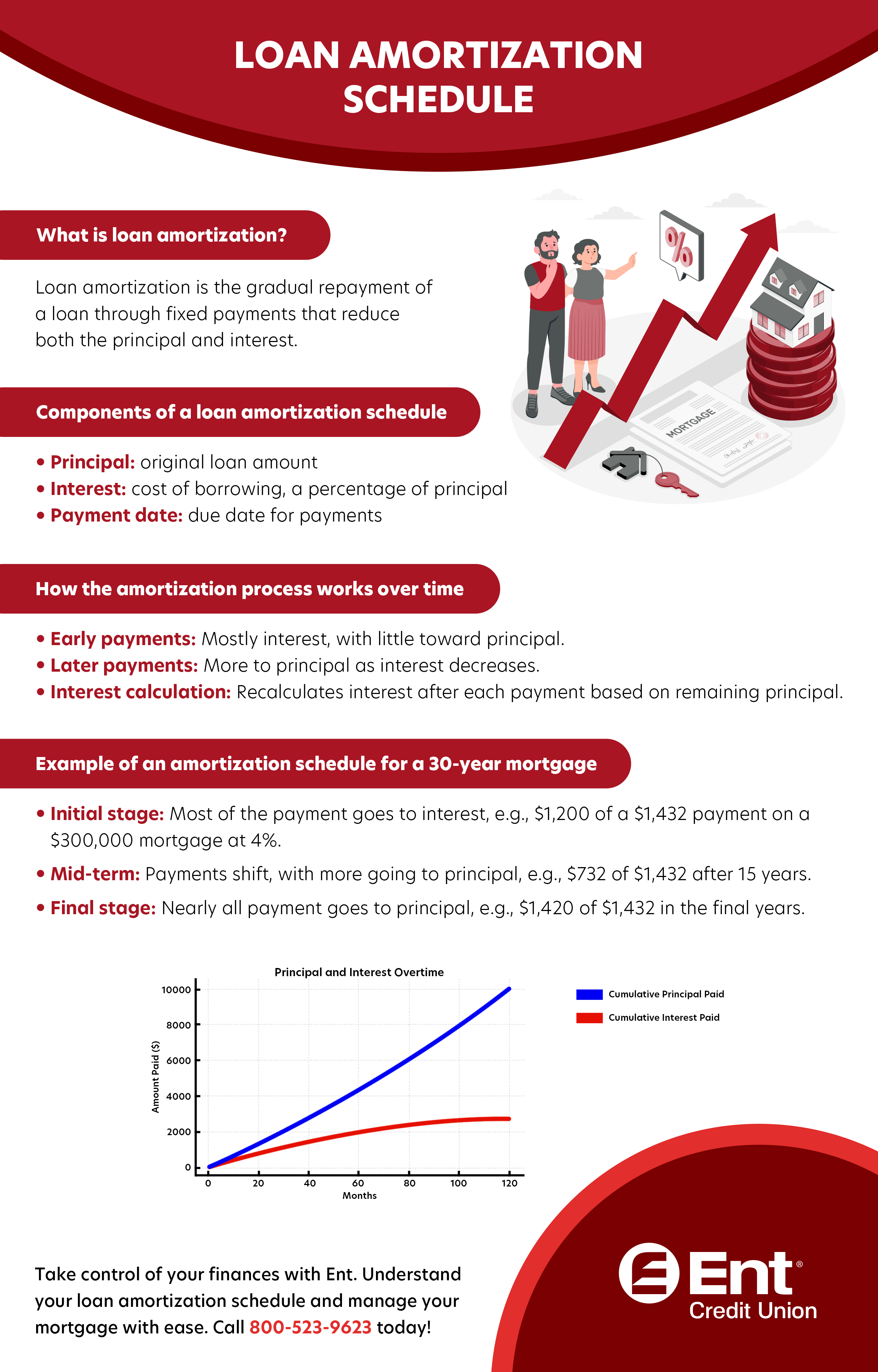

When you buy a home for the first time and take out a home loan, you will need to pay back the amount borrowed plus interest over a set period of time. The total amount of the loan, including the principal plus interest, is split into equal monthly payments. Every payment will go towards both the principal and interest. A loan amortization schedule shows you what percentage of your monthly payment goes towards the principal vs. interest. These percentages will change over time as you get closer to paying off the loan. Use a loan amortization schedule to determine how much you are paying in interest over the life of the loan.

Lesson Notes:

Lesson Notes:

A loan amortization schedule is a chart of all the monthly payments you will need to make until you pay off the loan entirely. If you have a loan with a fixed home interest rate, such as a fixed-rate 30-year mortgage, your monthly payment will stay the same every month, but the percentage of money going towards interest will change as you pay down the principal.

When you begin making payments on the loan, a large percentage of your monthly payment will go towards paying off the interest that has accrued on the loan. As you pay down the principal amount over time, you will accrue less interest every month and year, which means more of your money will go towards the principal. By the time you are close to paying off the loan, a large portion of your monthly payment will go towards the principal, with a much lower percentage going towards interest.

The loan amortization schedule shows every payment you will make during the repayment period. Every payment then gets broken down into a set of percentages that represent how much is going towards the principal vs. interest. You can use this chart to see how your monthly payment is being allocated.

The length of the loan amortization schedule depends on the length of the repayment plan, which may last anywhere from several months to several decades, depending on the type of loan. Having a longer amortization period will lower your monthly payment, but you will generally pay more in interest over the life of the loan. Shortening the amortization period can increase your payment, but you will typically pay less in interest and get out of debt that much faster.

The loan amortization schedule is helpful because it shows you how much you pay in interest in every month. You can use the chart to keep track of your progress in terms of paying off the principal amount and getting out of debt.

You can also use the chart to calculate how much equity you have in your home or vehicle. Calculate how much money you have put towards the principal since you started making payments on your loan. To calculate equity, determine the value of the home, divided by the remaining principal balance to see what percentage of you have in equity.

You are free to pay more than the required amount when repaying your loan every month. Depending on your long-term , you may want to consider putting more of your money towards your debt to reduce interest paid over time. Any extra money you put towards the loan will go entirely to the principal to help you pay off the loan as quickly as possible. The sooner you pay off the principal, the faster you will get out of debt. Keep in mind your original amortization schedule doesn’t account for additional payments to principal.

Some loan types only require you to pay the interest that has accrued on your loan during a draw period. In this case, 100% of your monthly payment will go towards interest. Consider paying more than the required amount to start paying down the principal before the repayment period begins.

Use a loan amortization schedule to see what percentage of your monthly payments will go towards interest based on your current repayment plan.

*PLEASE NOTE: This article is intended to be used for informational purposes and should not be considered financial advice. Consult a financial advisor, accountant or other financial professional to learn more about what strategies are appropriate for your situation.